"Crossvale has played a key role in our banking modernization, resulting in improved efficiency, customer satisfaction, and exceptional ROI. Their expertise, proactive approach, and ongoing support have been essential in achieving our goals."

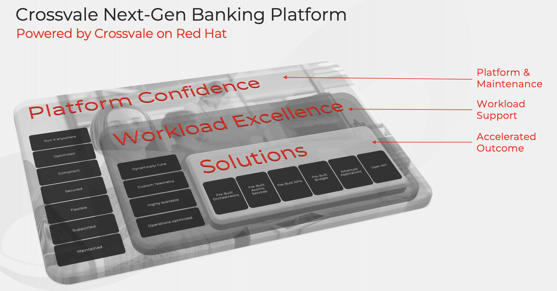

Crossvale Next-Gen Banking Platform, powered by Red Hat

Acquire and retain the next generation of customers

The banking landscape is changing

Today’s banking consumers are both more generous and more discerning. On the one hand, people are sharing more information about themselves than ever. On the other hand, they expect exceptional service in return.

Customer expectations have expanded to include types of services traditional banks may not be equipped to provide. A new generation of customers expects banks to behave like technology companies, providing ubiquitous access to services, cutting-edge functionality, and a consistent experience across platforms. And a new generation of technology-enabled financial services innovators—known as fintechs—are ready to swoop in and give it to them.

The future of banking will look very different

Fintechs are fundamentally changing the financial services landscape. Financial products and payment options are popping up in a variety of nontraditional places, from large telecommunications and IT companies to social media platforms and small retailers.

Yesterday, you were competing with the bank across the street. Today, you’re competing with Apple, PayPal, and even Amazon, Facebook, and Walmart. Enterprise-wide innovation is required to compete with digital disruptors whose presence is seeping into virtually every corner of the financial services market and into the virtual reality space of the metaverse. And it’s all happening at a breakneck pace.

But if you’re a traditional bank, you may be constrained by legacy investments, applications, and operational models—not to mention multiple compliance requirements. You could benefit from a well-planned modernization framework to guide your transformation from where you are today to where you need to be tomorrow.

-

-

- 55% of millennials are likely to make a purchase directly through a social media platform.

- 36% of all consumers are highly interested in using a digital bank in the next year.

- 73% of Gen Z consumers said they would be willing to make a purchase in the metaverse.

-

The Crossvale Next-Gen Banking Platform with Red Hat OpenShift

It’s clear that you need a modern toolbox for banking innovation. The Crossvale Next-Gen Banking Platform takes a top-down approach to modernization, using the Crossvale Modernization Framework and Red Hat technologies such as Red Hat® OpenShift® to help you modernize for the digital era.

You don’t have to go it alone

Modernization that creates business value is complex. It requires a modern technology toolbox for innovation along with agility and expertise. But you don’t have to go it alone. The Next-Gen Banking Platform from Crossvale helps you overcome the challenges of acquiring and retaining the next generation of customers. By embracing modern Red Hat technologies to enhance customer experiences, improve operational efficiency, and maintain compliance, Crossvale and Red Hat equip you with the tools, pre-built microservice and consulting you need to succeed in the digital banking era.

Save Years for Coding with Crossvale's OpenShift Operator for Banking

Benefit from readily deployable pre-built microservices that can swiftly modernize both your common banking channels and backends like:

-

-

-

-

-

- TSYS

- BlackKnight

- FIS IBS

- FIS Systematics

- Genesis IVR

- Salesforce

- Hubspot

- Twitter (X)

- FDR.

- ...

-

-

-

-

Contact us to schedule a personalized consultation and discover how our Next-Gen Banking Platform empowers your bank to thrive in the evolving banking industry.

Modernize quickly with low risk.

Go from zero to confident in days not months, Crossvale's Next-Gen Banking Platform enables your team to quickly integrate your existing channels and backend so you can use your data to improve customer experiences.

Start small with just a new channel you are adding to your ecosystem, this solution is scalable and very reasonably for small, medium or large deployments.

Next-Gen Banking Solution Brief

5 reasons why acting now is critical

Modernization and digital transformation can be challenging for internal IT teams, who are occupied with managing day-to-day operations and maintaining legacy equipment.

- Overcoming technical debt

Maintaining outdated systems is costly and time-consuming, taking away resources that could be applied to innovation. Next-generation solutions offer higher performance with better efficiency and simplified operations.

- Reducing operational cost.

Older infrastructure simply isn’t as efficient as next-generation infrastructure. Next-generation solutions are built to handle workloads that require more processing power while lowering power consumption to help you meet sustainability goals.

- Increasing agility and flexibility

Legacy infrastructure was built for the IT needs of yesterday. The pace of innovation required to keep up with the competition demands agile, flexible solutions that help you respond quickly to changing business needs.

- Enhancing competitiveness

Fintechs and traditional banks that are already using the latest technologies are more appealing to consumers. Failing to deliver the services consumers want puts you behind the competition, and every day you delay makes it harder to catch up.

- Reducing security and compliance risks

Cyber-criminals are incredibly sophisticated and are constantly looking for new ways to steal valuable financial data. Modernization provides a more secure approach to data risk and compliance requirements.

Branch-to-digital transformation

While the momentum for digital-first banking has been building for years, the pandemic and its aftermath are compelling traditional banks to redefine how they interact with customers.

- Technical and real estate debt impede innovation

Maintaining outdated IT systems and under-trafficked bank branches incurs needless costs, burning through resources that could be applied to innovation. Next-generation digital banking solutions are less costly to operate and enable digital services that increase revenues. - High operational costs

Older infrastructure simply isn’t as efficient as next-generation infrastructure and costs more to operate. Next-generation IT solutions deliver more processing power, more efficiently. - Less agility and flexibility

Keeping up with the competition requires agile, flexible IT solutions that help you respond quickly to changing business needs and offer services to anyone with an internet connection. - Reduced competitiveness

Fintechs and traditional banks that are already offering digital banking services are more appealing to consumers. Delivering excellent customer experiences can set you apart in a crowded market. - Increased security risks

Cyber-criminals are incredibly sophisticated and are constantly looking for new ways to steal valuable financial data. Modern IT provides a more secure approach to data risk and compliance requirements. Reducing the number of branches further reduces your attack surface.

IT Teams Struggle with Customer Experience

The banking lines of business are counting on IT to deliver capabilities that help enhance customer experiences. But it’s not as easy as flipping a switch. It requires careful evaluation of solutions that can help you overcome some of the most common issues standing in the way of customer experience initiatives.

- Existing systems are not event-driven and responsive in real time

The ability to activate and personalize experiences based on real-time streaming data including social media, behavioral, financial, and geospatial information is a customer experience game changer. For example, a bank can act quickly on valuable insights gained by using social media feeds to track public sentiment. - Databases are isolated

Unlocking value from business data at the point of need is a key requirement to improve the customer experience. But isolated databases impede creation of 360-degree customer profiles that help exceed customer expectations. IT is challenged to integrate data across multiple apps and systems, extract data from different formats and back-end systems, and incorporate real-time data streams. - Architectures are monolithic

Older legacy systems are based on monolithic architectures designed to be self-contained. Components are interconnected and interdependent. As such, these systems are difficult to modify. The rigidity of monolithic systems makes it hard to scale resources, deploy across multi-cloud environments, and innovate by integrating new microservices.

Engineering Blog

See all our events

Driving technology for leading brands

Our Clients